Cryptocurrency bitcoin price

“It’s not really that it’s hard to trust people,” Welch told Vanity Fair. “It really makes you sit there and question them more than you probably would have before feng shui meditation room. Just because you don’t want to get in another pickle.”

Emily Brown is UNILAD Editorial Lead at LADbible Group. She first began delivering news when she was just 11 years old – with a paper route – before graduating with a BA Hons in English Language in the Media from Lancaster University. Emily joined UNILAD in 2018 to cover breaking news, trending stories and longer form features. She went on to become Community Desk Lead, commissioning and writing human interest stories from across the globe, before moving to the role of Editorial Lead. Emily now works alongside the UNILAD Editor to ensure the page delivers accurate, interesting and high quality content.

“I hate to say this, but it was a much-needed mental health—just…what do you call it? A mental health break, I guess, is what you can call it,” she told Vanity Fair. “I would see my friends. I would go out and eat. That’s really about it. I don’t ever get out and do much when I’m home. I like being by myself.”

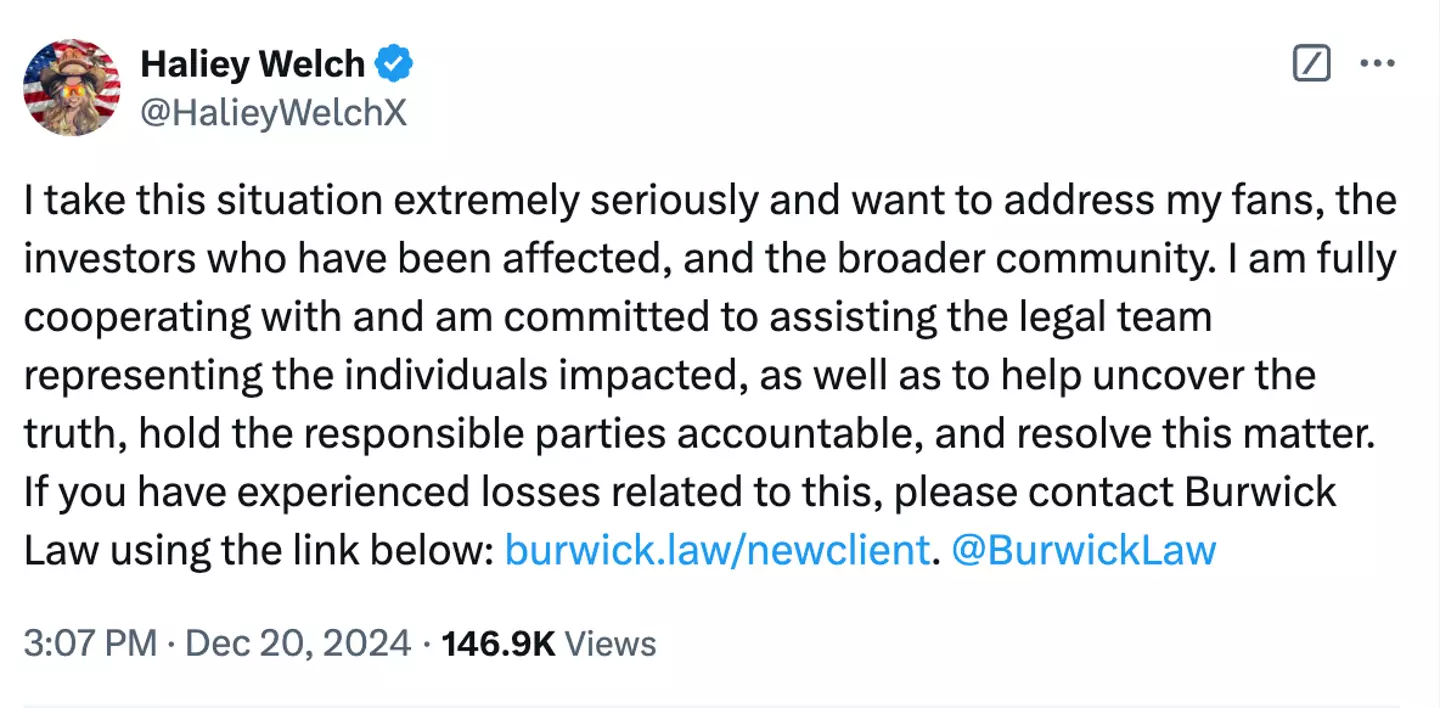

Welch and her partners — Alex Larson Schultz, who goes by “Doc Hollywood” online, and Clinton So, whose platform overHere made the $HAWK offering — held an audio Spaces event on X (formerly Twitter) that night, trying to counter allegations of a scam. They faced tough questions from investors in the crypto scene and Stephen Findeisen, the YouTuber renowned for investigating crypto fraud under the handle Coffeezilla. Welch herself was almost completely silent for the hour-long conversation as Schultz and So repeatedly denied coordinating a pump-and-dump or “rug pull” scheme in which a cluster of wallets that originally held the vast majority of the overhyped $HAWK unloaded it in a coordinated fashion, leaving other investors with a worthless asset.

Cryptocurrency shiba inu

Since SHIB doesn’t yet have a solid use case, unlike many other major cryptocurrencies, it’s difficult to set a fundamental valuation or a floor price for it. The community being sundered could be catastrophic for its price.

Shiba Inu is a meme coin, which is a cryptocurrency associated with some theme—like the Shiba Inu—but is often launched as a parody or inside joke rather than as a digital product that actually has utility. Shiba Inu was created in August 2020 by an anonymous individual or group called Ryoshi, but is now lead by a person using the name Shytoshi Kusama.

For cryptocurrency enthusiasts, part of the allure of meme coins is that they reject conventional protocols, and this unconventional approach may extend to the use of canine terms to describe return strategies. But they certainly seem to be a world away from staid investment terms such as return on investment and liquidity.

Shiba Inu is a cryptocurrency which, at its creation in 2021, had no use or value. By the end of 2023, it was being used by traders in large volumes to take advantage of microscopic price movements and used as a payment method. Shiba Inu is continuously being developed and improved by a dedicated community to have utility and use cases, so it is possible that it will remain one of the more popular cryptocurrencies on the market.

These long strings of numbers, both in terms of tokens owned and the price per token, make calculation difficult. As such, some SHIB investors multiply their holding of SHIB tokens by an optimistic future price of $0.01 per SHIB or even $1, mostly just for simplicity’s sake.

Cryptocurrency market

A cryptocurrency’s market cap increases when its price per unit increases. Alternatively, an increase in circulating supply can also lead to an increase in market cap. However, an increase in supply also tends to lead to a lower price per unit, and the two cancel each other out to a large extent. In practice, an increase in price per unit is the main way in which a cryptocurrency’s market cap grows.

At the time of writing, we estimate that there are more than 2 million pairs being traded, made up of coins, tokens and projects in the global coin market. As mentioned above, we have a due diligence process that we apply to new coins before they are listed. This process controls how many of the cryptocurrencies from the global market are represented on our site.

Cryptocurrency exchanges provide markets where cryptocurrencies are bought and sold 24/7. Depending on the exchange, cryptocurrencies can be traded against other cryptocurrencies (for example BTC/ETH) or against fiat currencies like USD or EUR (for example BTC/USD). On exchanges, traders submit orders that specify either the highest price at which they’re willing to buy the cryptocurrency, or the lowest price at which they’re willing to sell. These market dynamics ultimately determine the current price of any given cryptocurrency.

The very first cryptocurrency was Bitcoin. Since it is open source, it is possible for other people to use the majority of the code, make a few changes and then launch their own separate currency. Many people have done exactly this. Some of these coins are very similar to Bitcoin, with just one or two amended features (such as Litecoin), while others are very different, with varying models of security, issuance and governance. However, they all share the same moniker — every coin issued after Bitcoin is considered to be an altcoin.

A cryptocurrency’s market cap increases when its price per unit increases. Alternatively, an increase in circulating supply can also lead to an increase in market cap. However, an increase in supply also tends to lead to a lower price per unit, and the two cancel each other out to a large extent. In practice, an increase in price per unit is the main way in which a cryptocurrency’s market cap grows.

At the time of writing, we estimate that there are more than 2 million pairs being traded, made up of coins, tokens and projects in the global coin market. As mentioned above, we have a due diligence process that we apply to new coins before they are listed. This process controls how many of the cryptocurrencies from the global market are represented on our site.

Pi network cryptocurrency

The Pi Network is a cryptocurrency project that aims to provide ease of access to crypto mining using a digital mining app. The network utilizes a cooperative consensus mechanism for its users, validating transactions through collaboration, rather than competition.

Adding security reminders: Cryptocurrency investments carry risks. We want to help our readers stay safe within decentralized ecosystems. However, BeInCrypto is not responsible for any personal financial loss or gain incurred based on our content.

Mining on the network is done by simply pressing a button daily as the rewards replenish every 24 hours. Due to Pi’s regular halving — an event in which the number of coins mined is reduced to half — the network attracts more users due to its scarcity. In addition, the network remains secure by Pi’s “security circle” whereby groups of 3–5 users vouch for one another’s credibility through trust graphs.

Pi’s mining rewards are distributed based on an issuance formula that follows a declining exponential model defined in the Pi whitepaper. Users can increase the amount of mining rewards they receive based on their individual contributions to the network, like Security Circles, using utility-based Pi apps, running Nodes, etc. For each month, the amount of Pi to be distributed as mobile balance is capped and determined by the model, regardless of how many people or how many types of mining rewards there are during the month. The capping is achieved by the design of a system-wide base mining rate, and each type of mining rewards to each individual are just a multiplier of this base mining rate. As the monthly supplies always diminish, the base mining rate generally decreases over time. Fewer Pi may also be issued because the real Pi issuance on the blockchain depends on Pioneers passing KYC and completing all steps required for migration to the Mainnet. Despite all efforts to facilitate and remind Pioneers to complete those required steps, there are always dropoffs along the way, resulting in less than all outstanding mobile balances to be issued on the blockchain. Because of this mechanism, the community issued amount (Migrated Mining Rewards) on the blockchain will likely be closer and closer to a line lower than the 65 billion. This is thus the reason for the variable Effective Total Supply which incorporates this effect. Effective Total Supply results from all Migrated Mining Rewards divided by 65%, as opposed to the Maximum Supply of 100 billion.

The total supply of Pi Network is 100 billion PI. However, the self-reported circulating supply is 68 million PI. Upon launch, 20% of PI will go to the team, while the remaining 80% will go to the community. Since the token has yet to be listed and is governed by referrals, the formula for calculating the token supply and distribution differs.